Introduction

As the UAE’s real estate sector continues to thrive, both Abu Dhabi and Dubai stand out as key markets, each offering unique dynamics and investment potential. Whether you’re a seasoned investor or a prospective homeowner, understanding the differences between these markets can help you make informed decisions.

Here’s a comprehensive overview and comparison of the real estate trends and opportunities in both cities for Q3 2024 Based on Property Finder Market Watch Report.

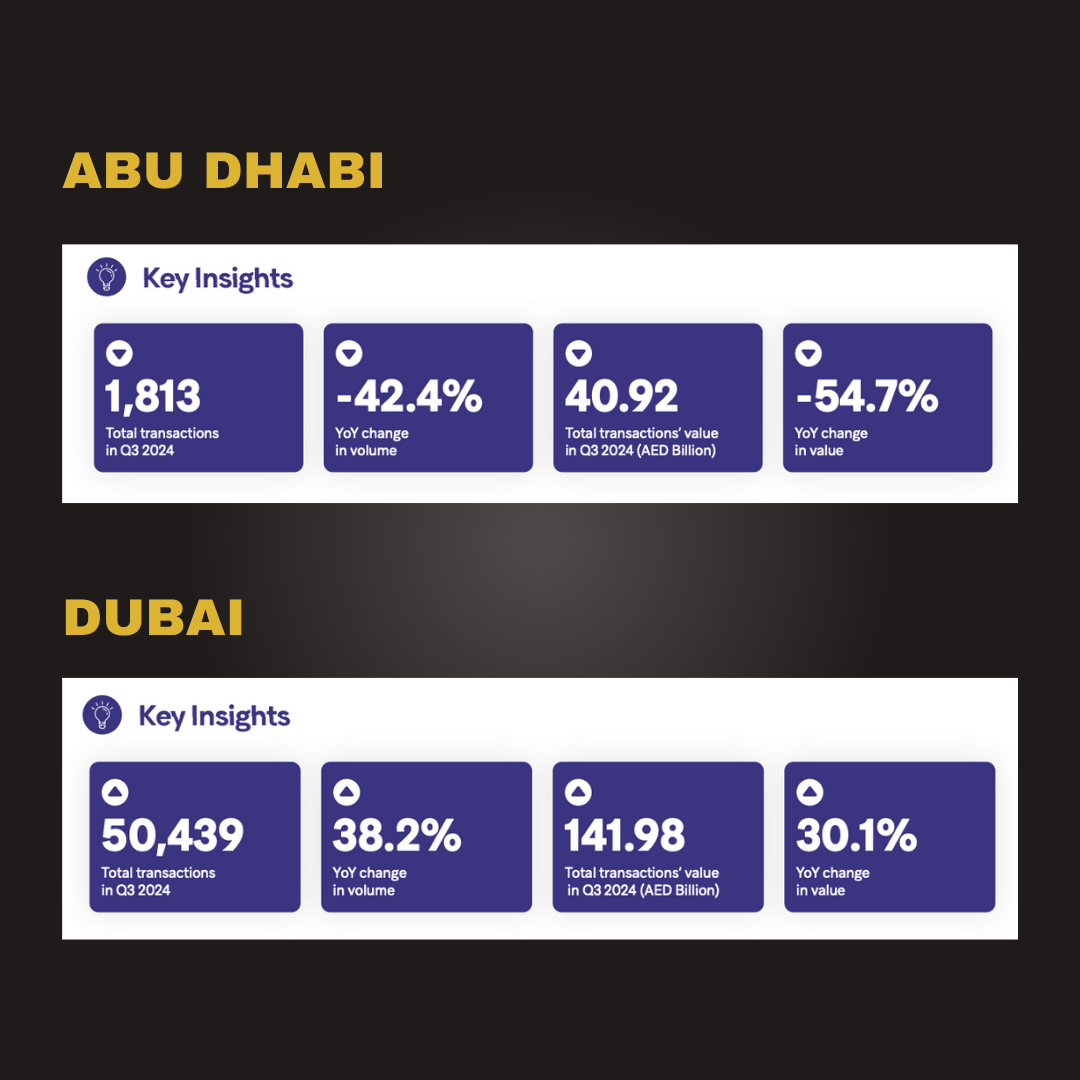

Market Overview

Dubai Real Estate Market Dubai’s real estate market remains robust, driven by its global appeal, a diversified economy, and investor-friendly regulations. The city’s continuous infrastructure development, luxury property offerings, and status as a business hub make it an attractive option for both local and foreign investors.

In Q3 2024, Dubai saw steady demand in its high-end residential and commercial sectors, with many buyers looking for properties in prime locations.

Abu Dhabi Real Estate Market In contrast, Abu Dhabi’s market is characterized by a more stable and conservative approach, often supported by government-backed projects and strong economic fundamentals.

The capital city’s focus on creating sustainable communities and its regulatory emphasis on long-term growth make it an appealing choice for buyers looking for stability and less speculative investment. Q3 2024 witnessed increased demand in luxury properties and upcoming community developments, largely in areas with waterfront and city views.

Key Comparison Points

Criteria | Dubai | Abu Dhabi |

Investment Appeal | High global investor interest, thanks to open market policies and visa incentives. | Primarily attracts long-term investors seeking stability, especially in high-net-worth segments. |

Market Dynamics | High volume of transactions; more volatile with potential for higher short-term gains. | Steady growth, with a focus on sustainable development and long-term returns. |

Price Trends | Fluctuating; premium areas like Palm Jumeirah and Downtown see significant appreciation. | Stable prices with gradual growth, particularly in areas like Al Reem Island and Saadiyat Island. |

Popular Property Types | High demand for luxury villas, apartments, and branded residences. | Demand centered around waterfront apartments, villas, and sustainable communities. |

Government Initiatives | Visa reforms, foreign ownership benefits, and economic free zones boost Dubai’s appeal. | Government-funded projects and sustainability-driven regulations attract high-net-worth individuals. |

Key Analysis Points

Demand for Luxury Properties: Both cities saw an increase in the demand for luxury properties in Q3 2024, with investors seeking premium waterfront and high-end apartments. Dubai’s Downtown and Palm Jumeirah areas and Abu Dhabi’s Al Reem and Saadiyat Islands remain hot spots.

Incentives and Investor Sentiment: Dubai’s investor-friendly policies, including long-term visas and open foreign ownership, continue to drive international demand. Abu Dhabi’s regulatory framework, however, appeals more to investors who prioritize stability over high returns.

Sustainability Focus in Abu Dhabi: Abu Dhabi is committed to creating sustainable urban communities, which are a major attraction for investors seeking long-term growth in eco-conscious projects. This stands in contrast to Dubai’s emphasis on rapid development and luxury-focused projects.

Rental Yields: Dubai typically offers higher rental yields, especially in popular residential zones, attracting investors looking for short-term rental income. Abu Dhabi offers moderate yields but provides more consistent returns due to its focus on resident-friendly developments.

Market Stability: Dubai’s market can be more volatile, providing higher short-term gains but also subject to fluctuations. Abu Dhabi’s market stability and conservative approach make it appealing for those seeking reliable long-term returns.

Analytical Insights

From a Rose Island’s data analyst’s perspective, the trends in Q3 2024 underscore each city’s unique approach to real estate development. Dubai’s market continues to reflect high transaction volumes and price appreciation in prime locations, showing an upward trajectory in investor confidence. However, this also implies a degree of market volatility, as prices in luxury segments experience sharp rises.

In contrast, Abu Dhabi’s data reflects a steady growth pattern, with increased interest in sustainability-driven projects. This consistency in growth is attractive for investors with a lower risk tolerance, particularly in high-net-worth segments. The capital city’s emphasis on sustainability also sets it apart, as global demand for eco-friendly living spaces continues to rise.

Key Takeaways for Investors

For Short-Term Investors: Dubai’s high demand in premium areas offers quick gains but requires close monitoring of market trends.

For Long-Term Investors: Abu Dhabi’s stable growth and sustainable community developments align well with long-term investment goals.

For Eco-Conscious Investors: Abu Dhabi’s focus on sustainability provides opportunities in eco-friendly communities, particularly attractive as global awareness around green living rises.

Investors should stay informed about regulatory changes and market trends in both cities to make well-timed, strategic investments.

Conclusion

Ultimately, both Abu Dhabi and Dubai offer distinct real estate opportunities that cater to varying investor preferences. Dubai is well-suited for those seeking high returns in a fast-paced market, while Abu Dhabi appeals to investors looking for stability and sustainable growth.

Deciding between these markets will largely depend on individual investment goals, risk appetite, and lifestyle preferences. Whether opting for the dynamic allure of Dubai or the stability of Abu Dhabi, the UAE’s real estate market in Q3 2024 promises opportunities for growth and diversification.

Check Out Mortgage Calculator

- Down Payment

- Loan Amount

- Monthly Mortgage Payment